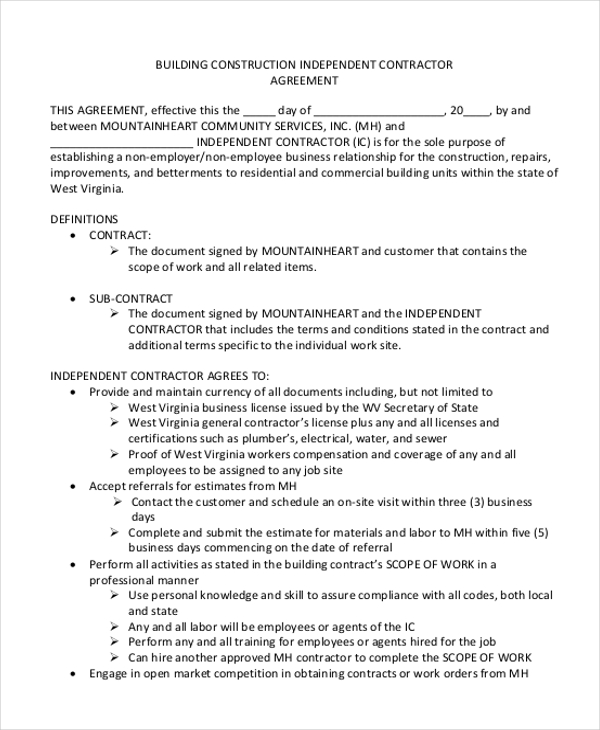

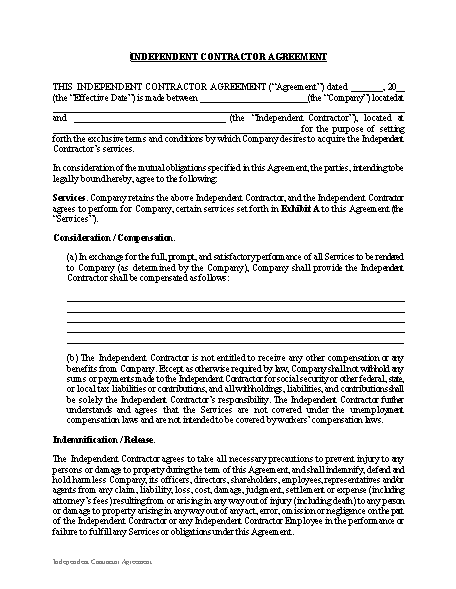

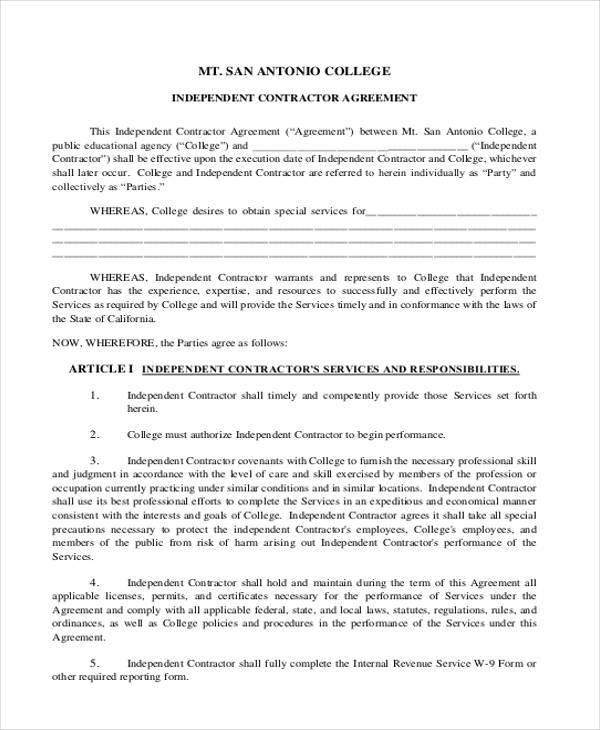

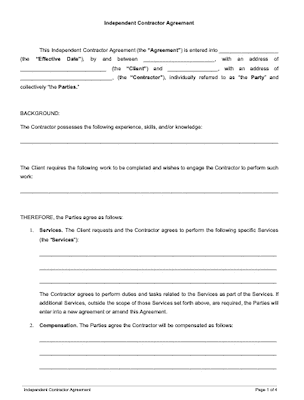

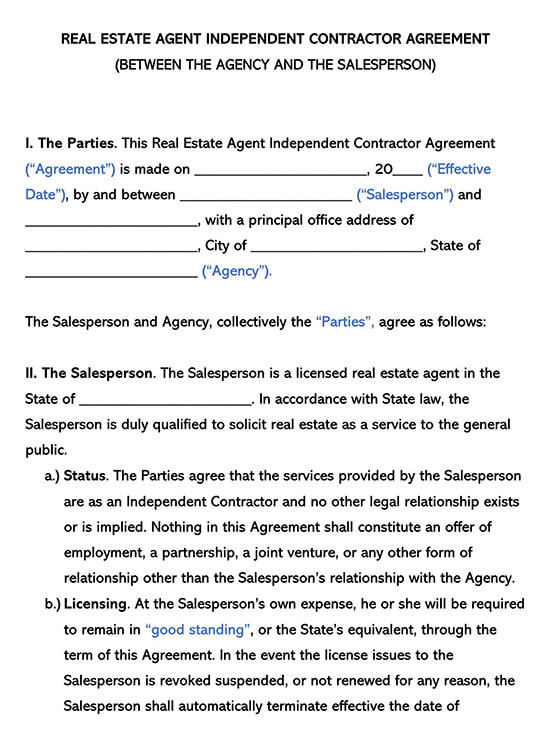

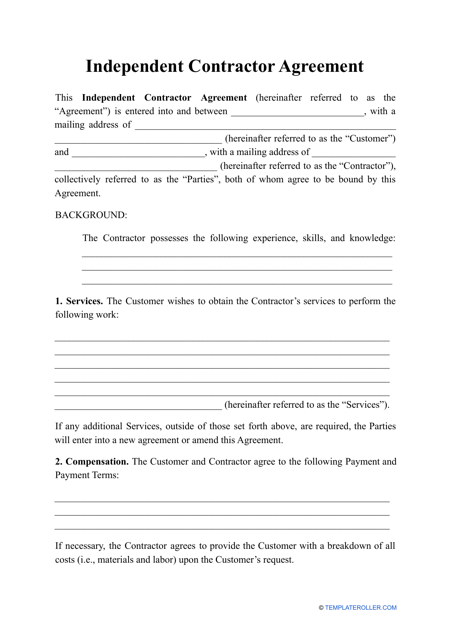

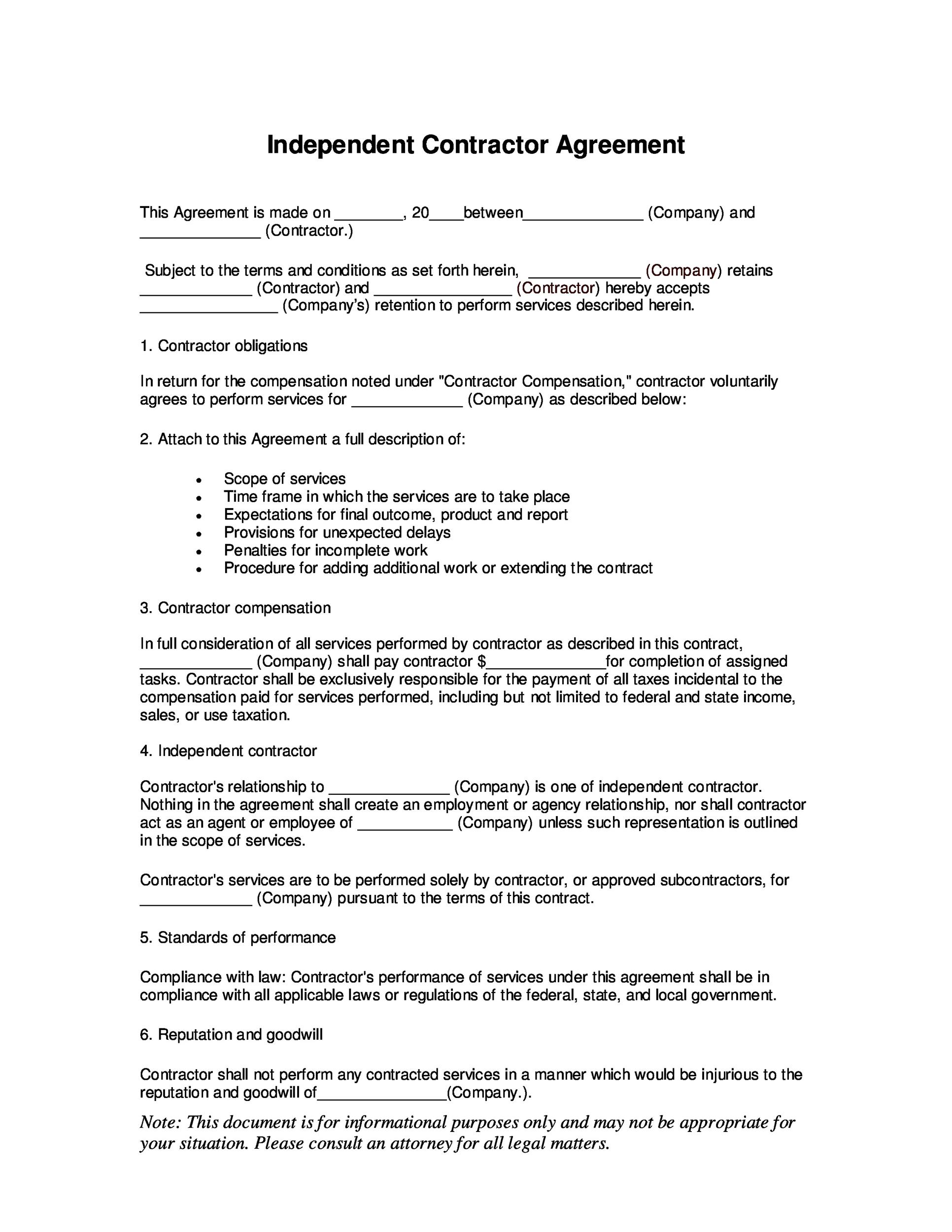

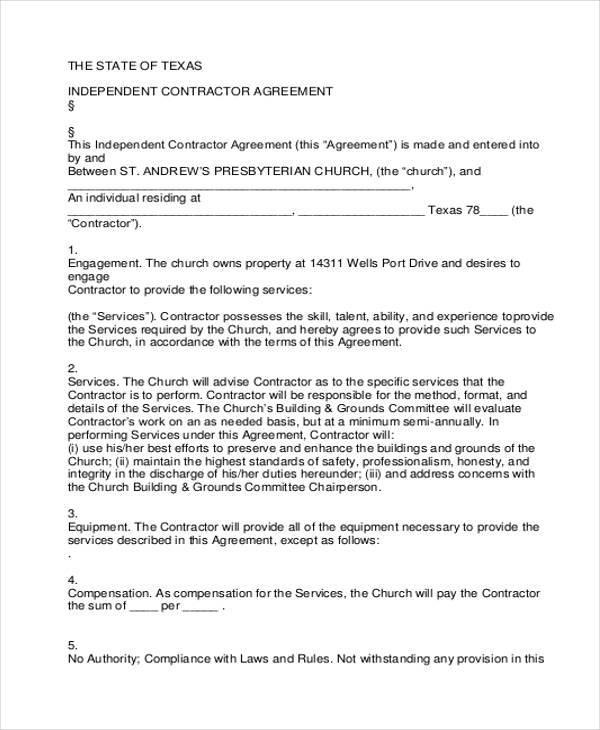

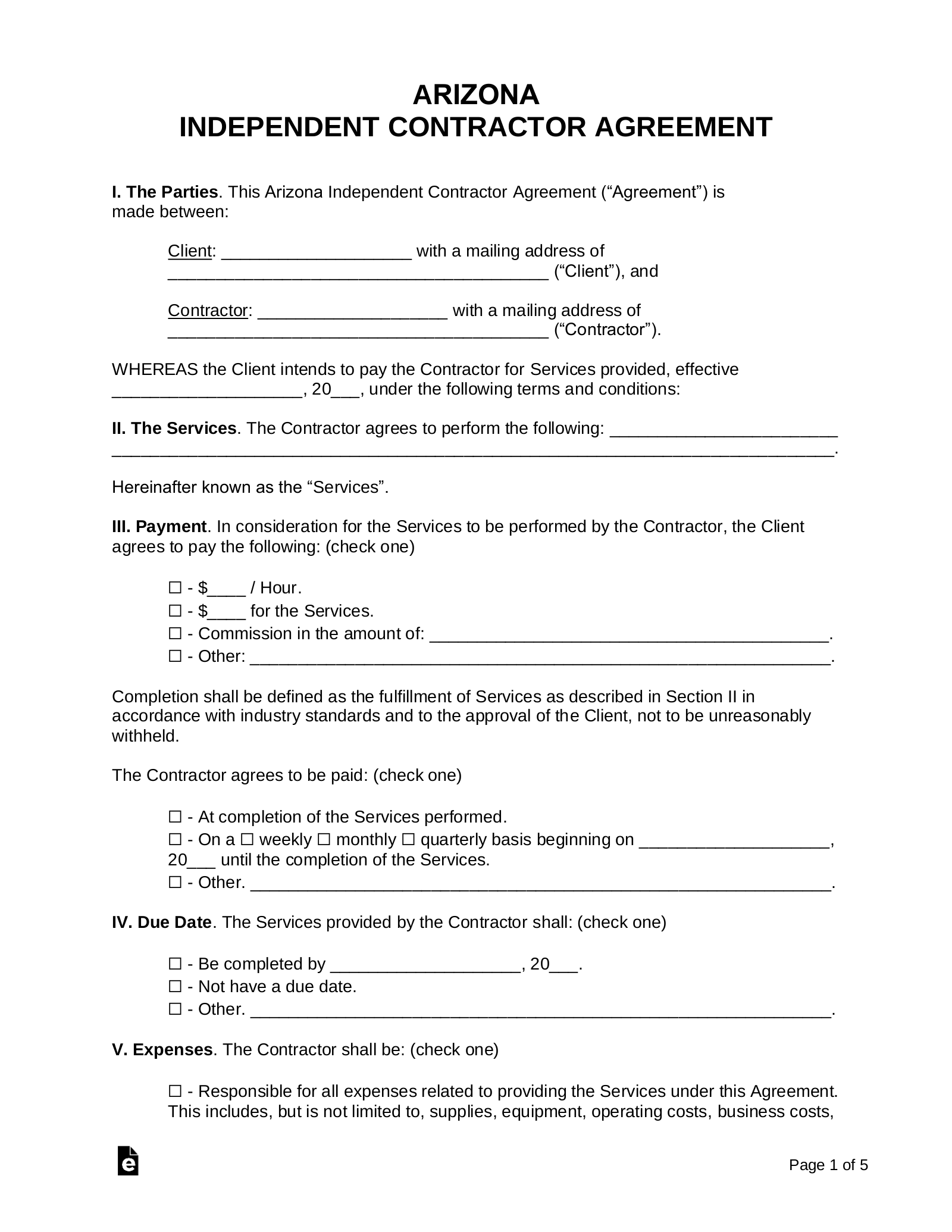

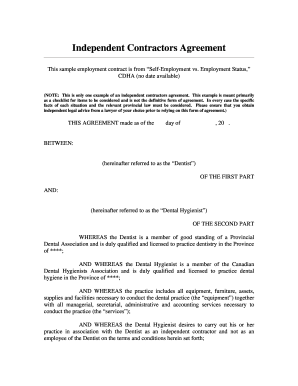

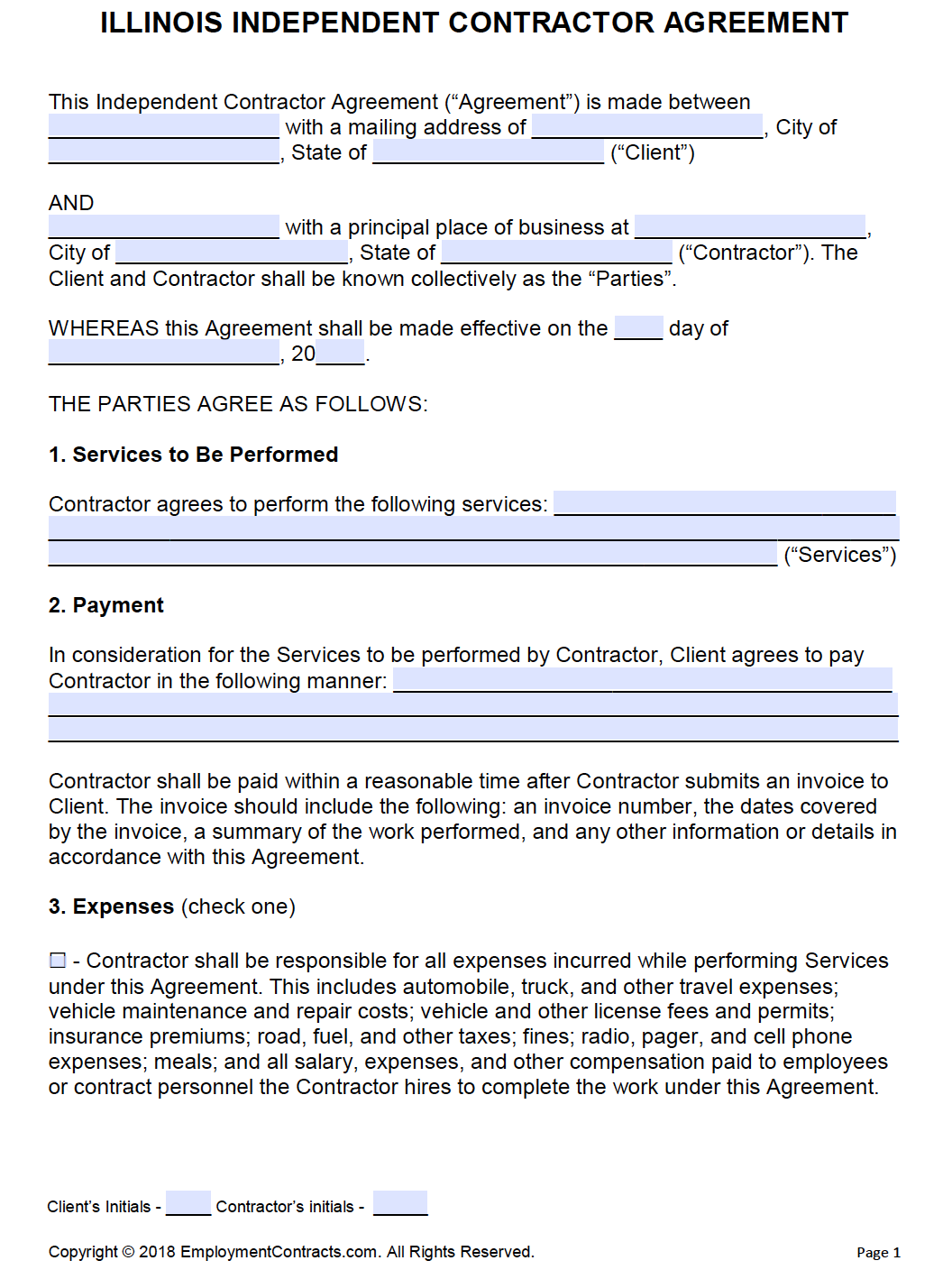

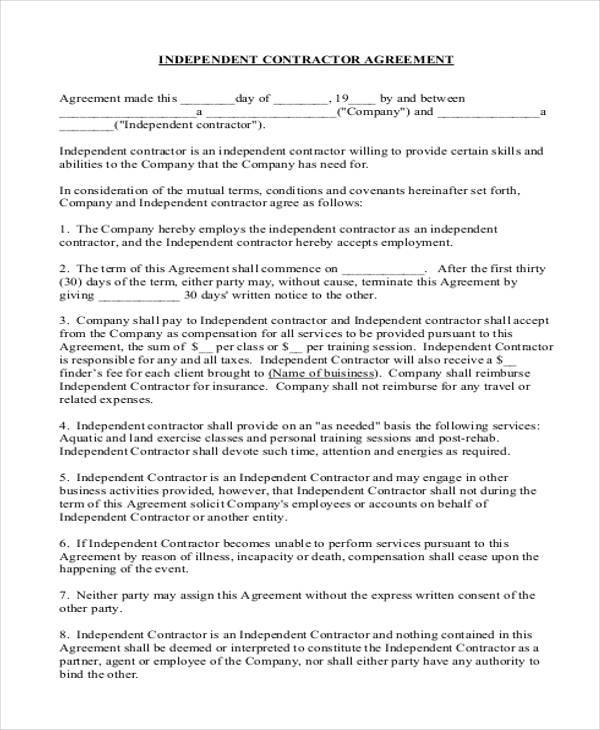

Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply)Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesIndependent contractor agreement note this form applies only to the state of arizona agencies, boards, commissions, and universities utilizing independent contractors this form does not apply to employers in the construction industry that use a contractor a certificate of workers' compensation insurance or a sole

Free Independent Contractor Agreement Templates Word Pdf

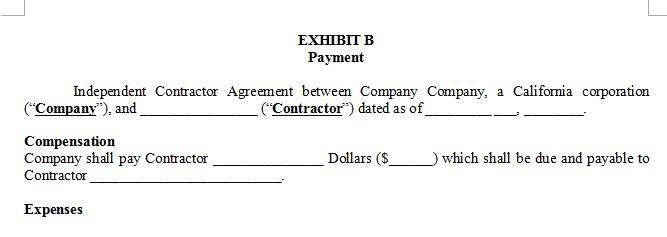

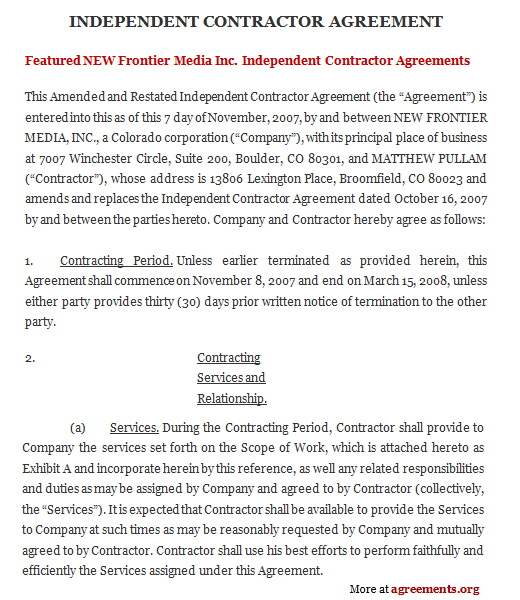

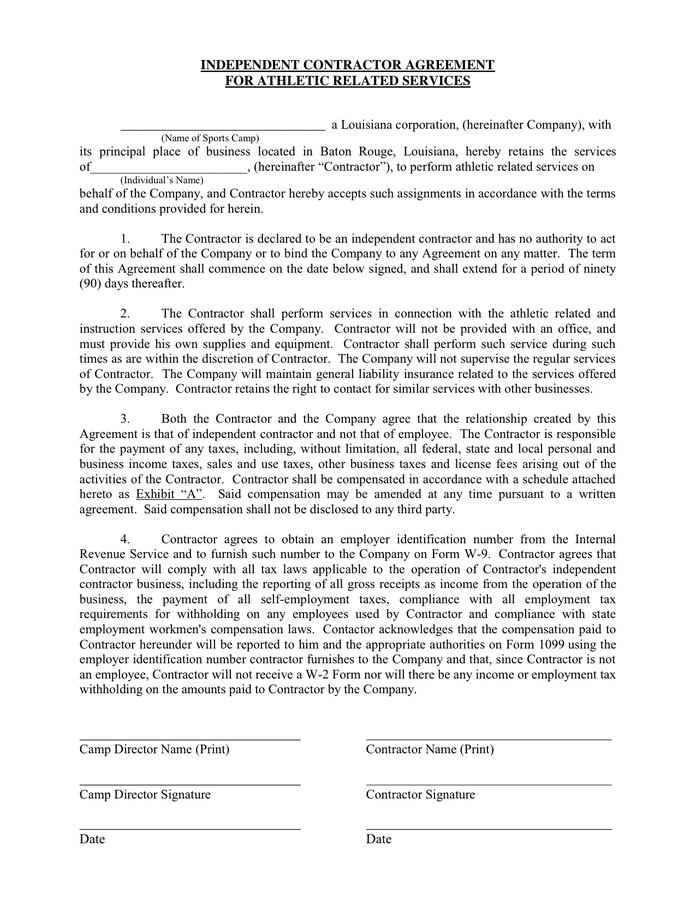

1099 contractor sample independent contractor agreement

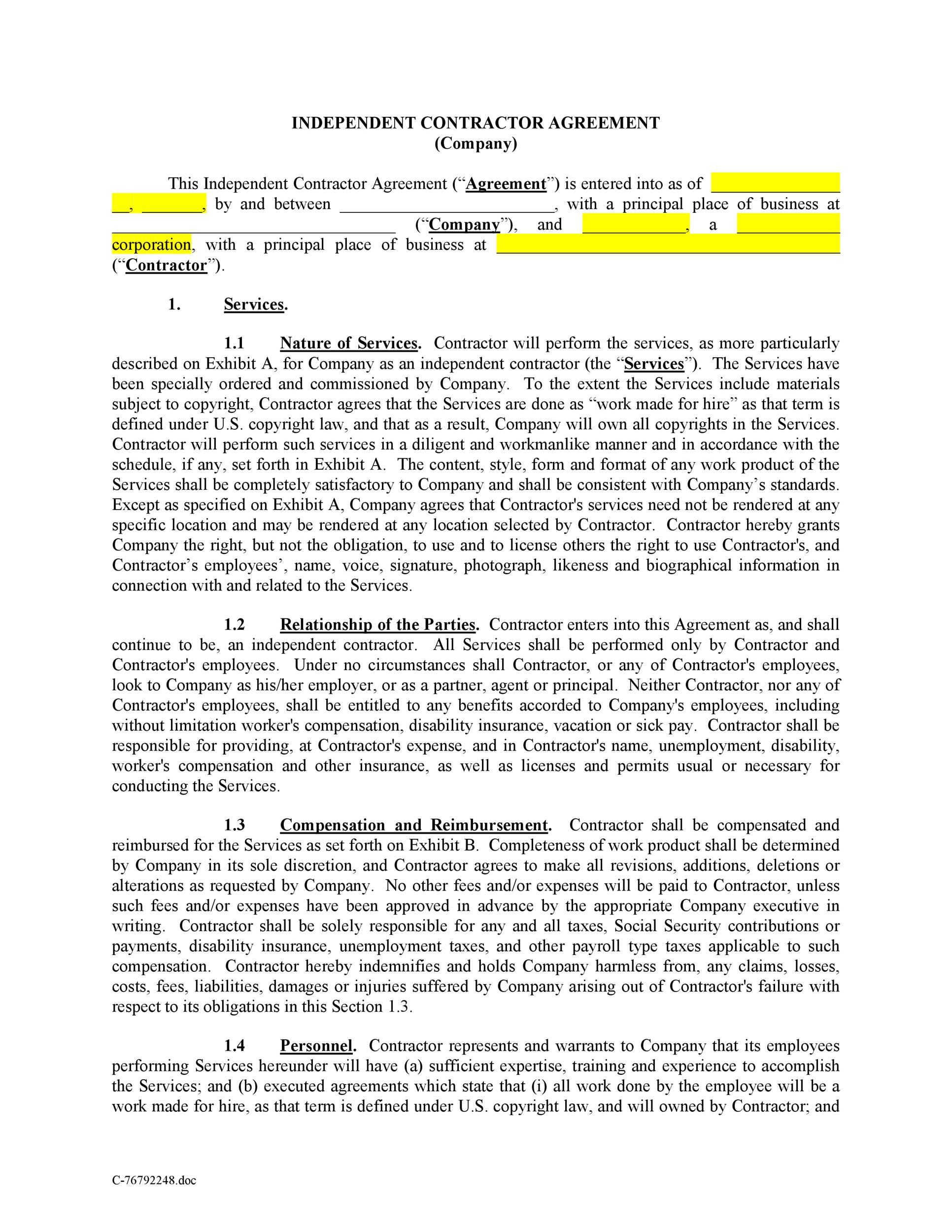

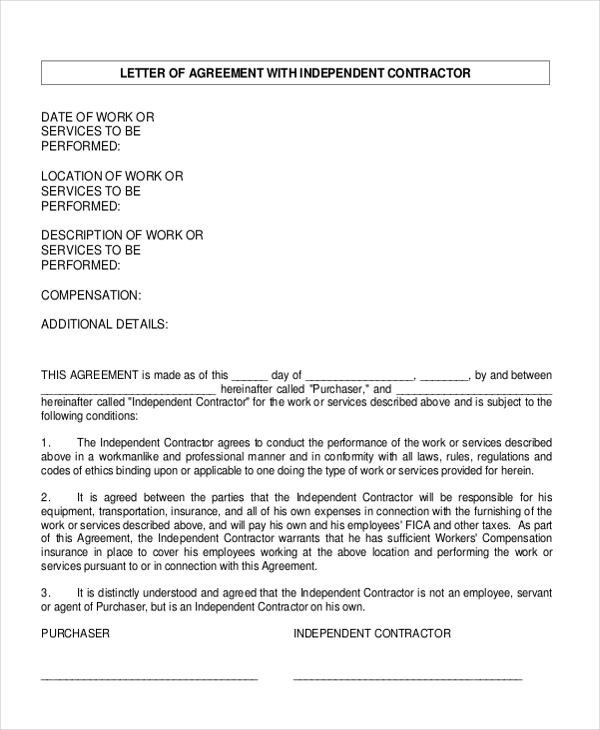

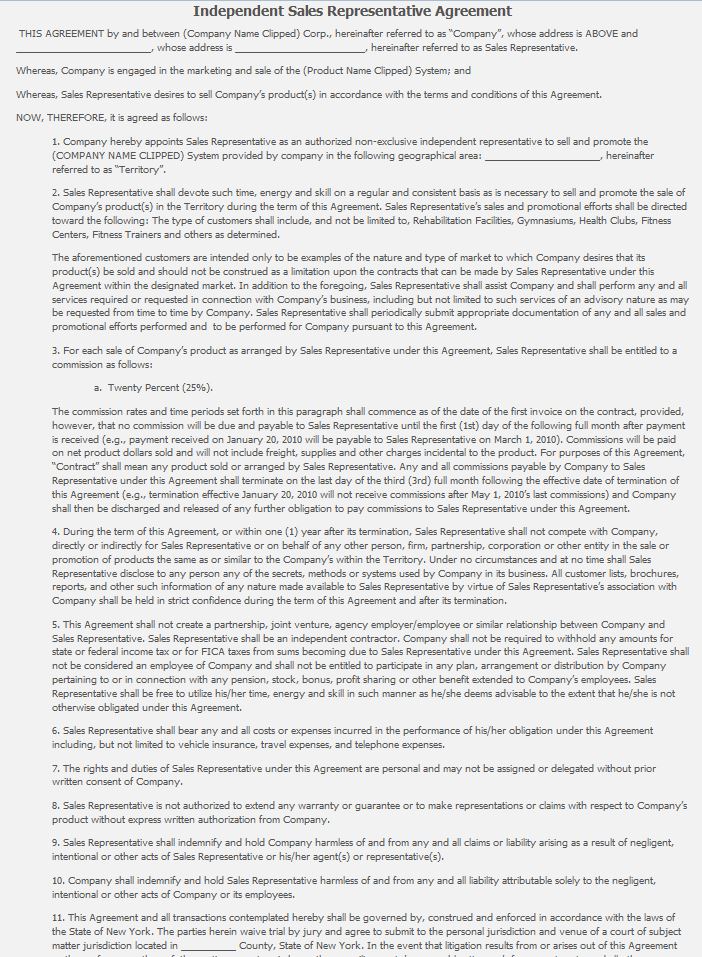

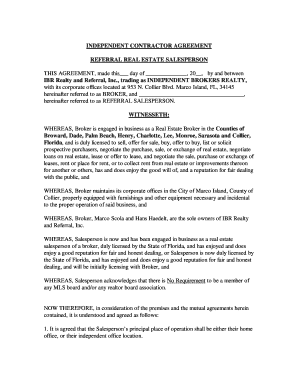

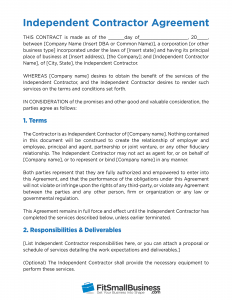

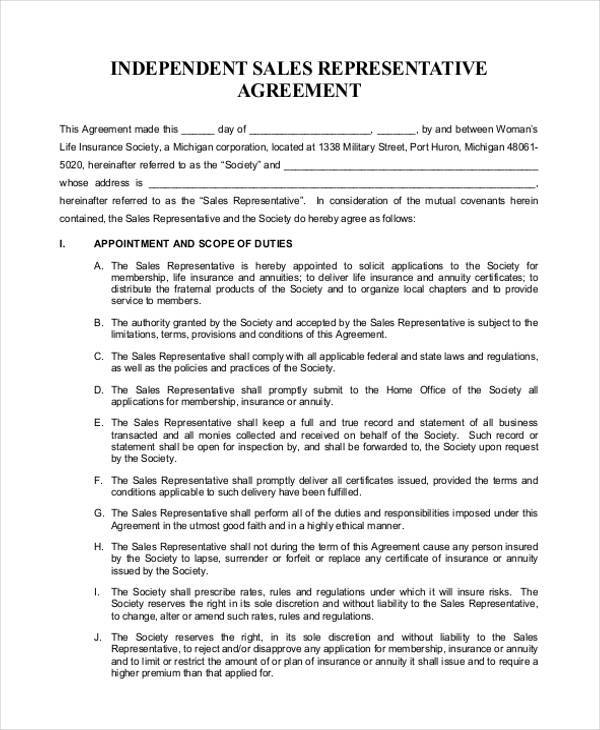

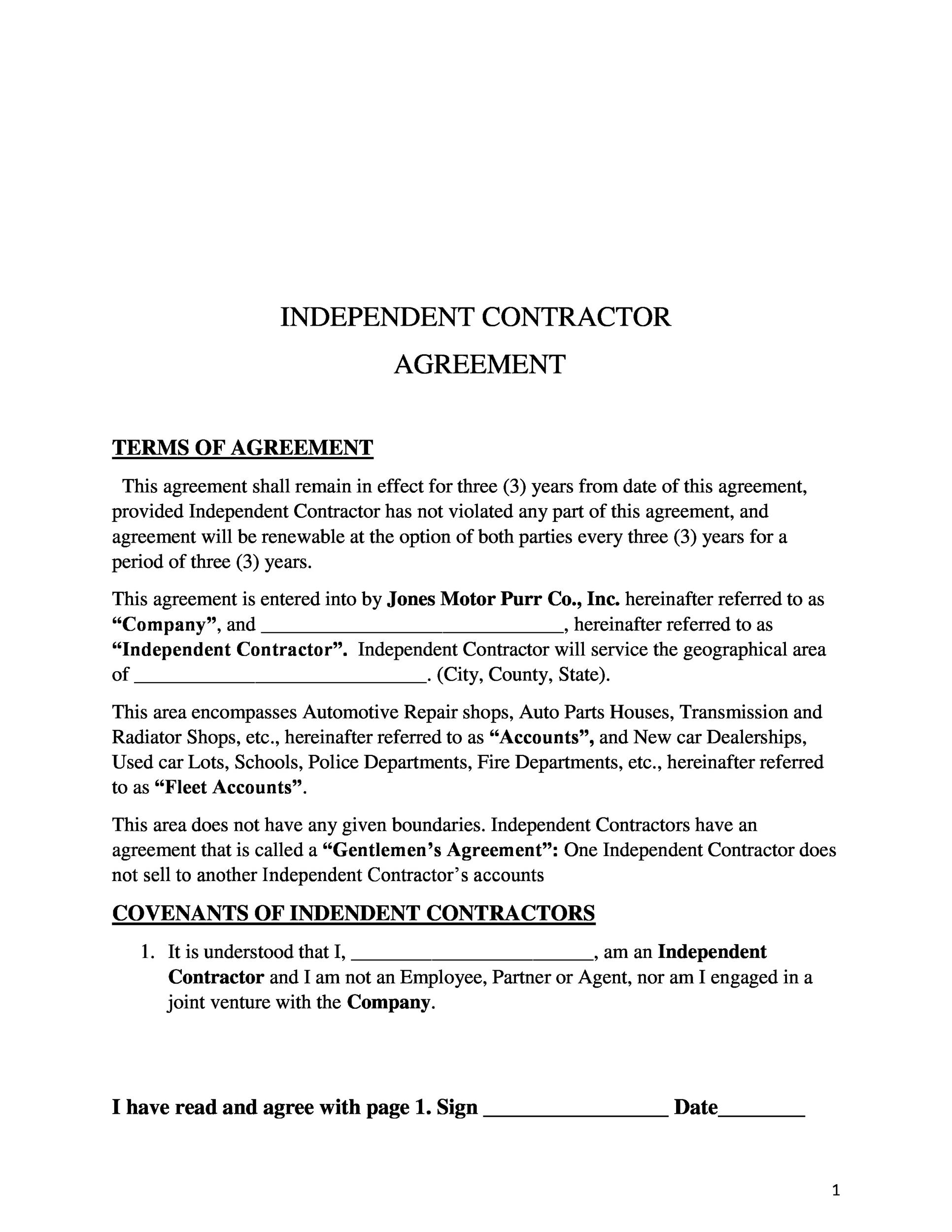

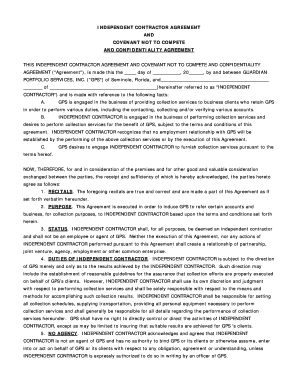

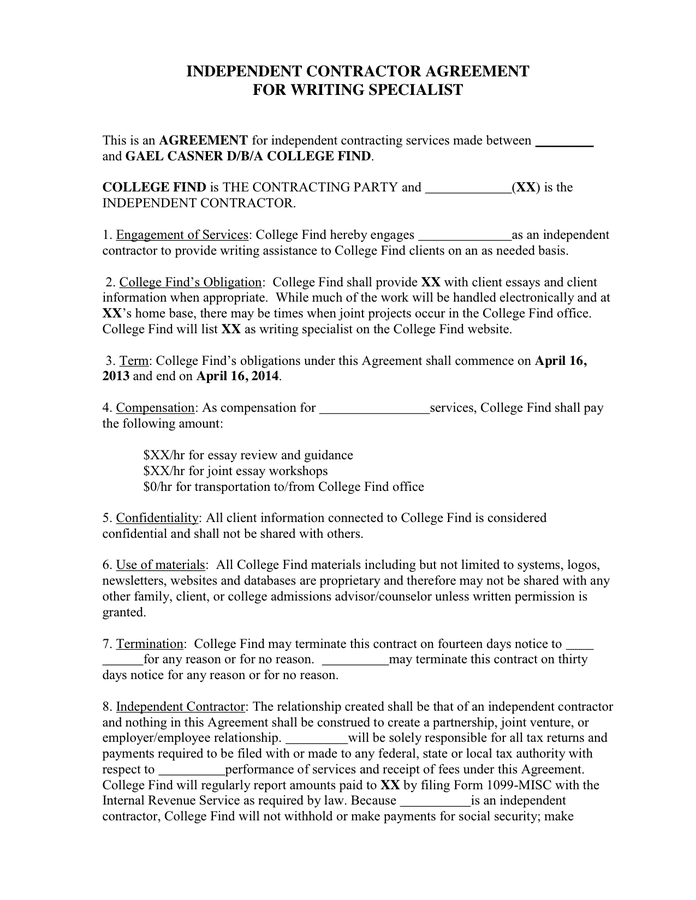

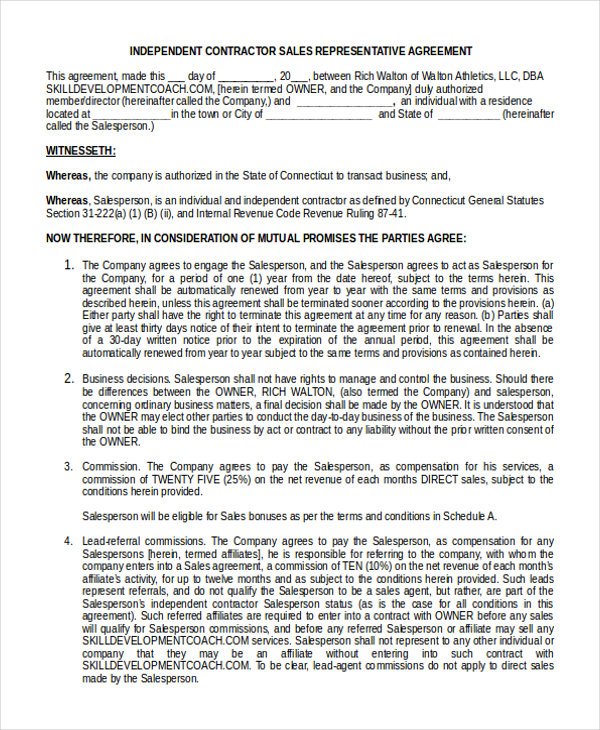

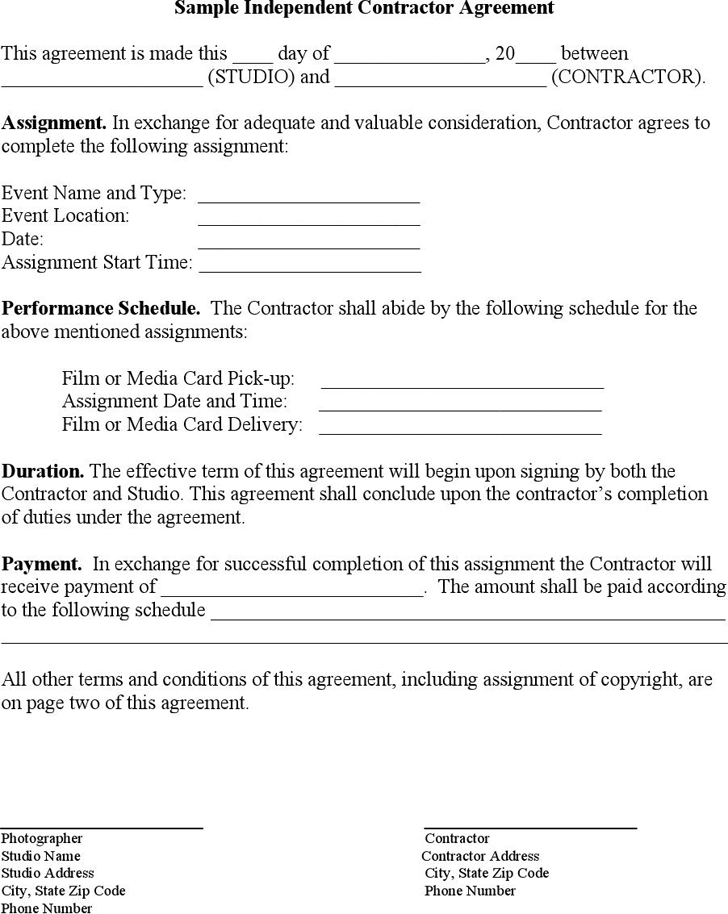

1099 contractor sample independent contractor agreement-CAS Independent Contractor Agreement (6 per month)wpd INDEPENDENT CONTRACTOR AGREEMENT THI S I NDEPENDEN T CONTRACTOR AGREEMENT (t he " Ag reement ") is ente red into as of _____, 08 (the "Effective Date"), by and between _____, an individual (the "Contractor"), and COLORADO ANESTHESIA SERVICES, LLC, a Colorado limited liability The contract with the independent sales rep is the best way to show that the person is an independent contractor The document should state that the sales rep is a contractor and spell out what he or she does, how often and how much he or she is paid, and provide a definition of how commission is paid out, such as getting 15 percent of each sale

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

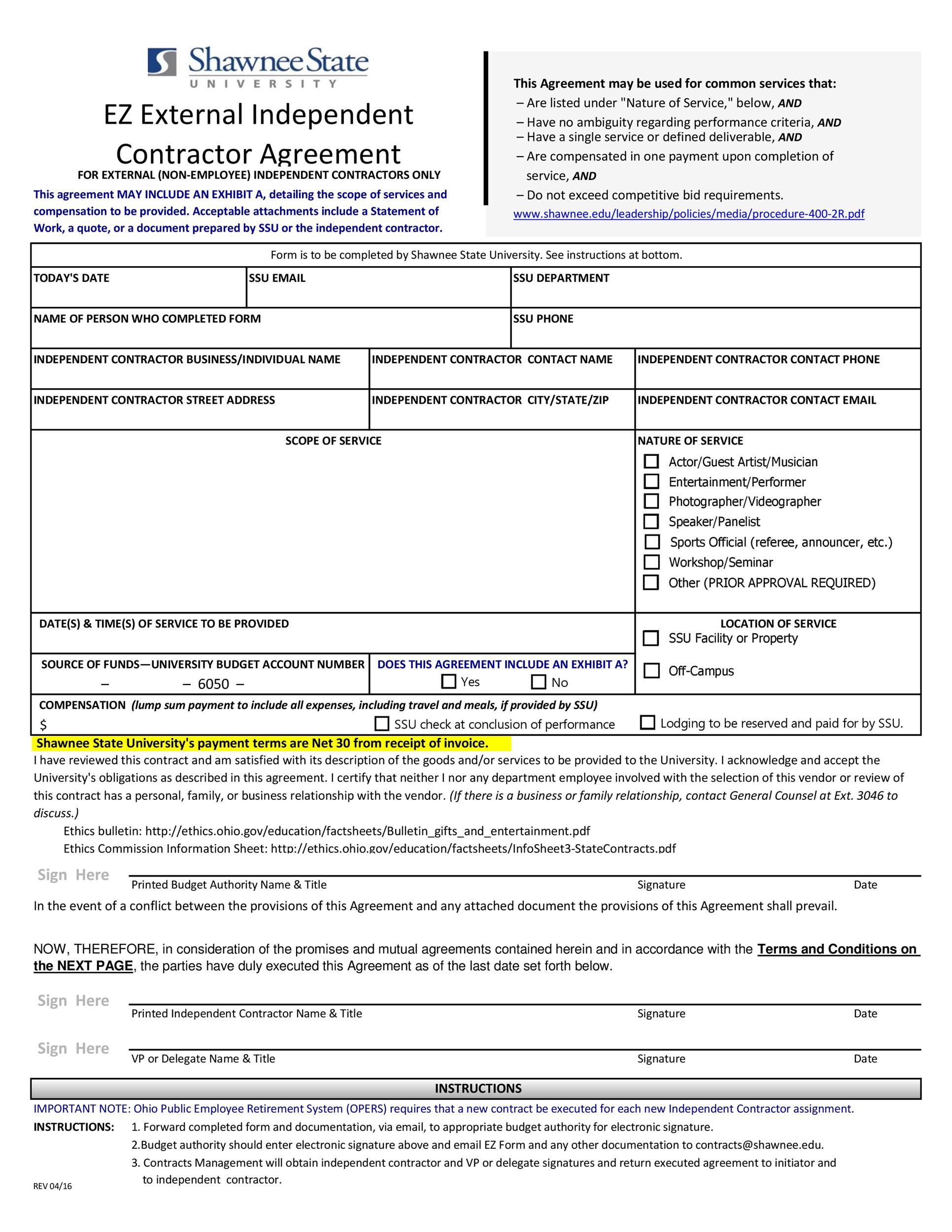

Download this customizable sample independent contractor agreement by Ryan Robins An easy to fill general independent contractor contract sample by Jyssica Schwartz This flexible work for hire agreement sample from Docsketch While we've done our best to find useful contract templates for you, this isn't legal advice, and Wise cannot be held Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting themIndependent contractors who aren't covered for workers' compensation Carefully review the tests outlined in the next two tabs Document how each contractor passes each part of each test Having a UBI number or contractor registration number does not automatically make a worker an exempt independent contractor

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and independent contractor No employer/employee relationship is created, and neither party is authorized to bind the other in any way ContractorAs well as your own health benefits, medical expenses, life insurance, and retirement fund(b) Contractor will not violate the terms of any agreement with any third party;

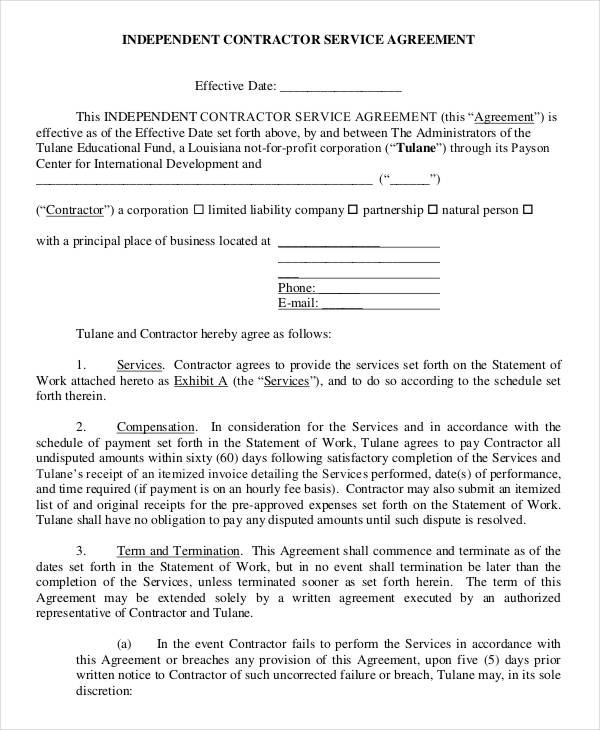

CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the otherContractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company;Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year if

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Use A Nda With Independent Contractor Agreements Everynda

Independent Contractor Agreement (1099) An independent contractor agreement is a contract between a client that pays a 1099 contractor for their servicesAn independent contractor is not an employee In most cases, an independent contractor is paid on a perjob or percentage (%) basis, not by the hour ($/hr)Independent contractor agreements serve to protect all parties involved in the transaction The contract sets clear expectations for the work and end product and provides legal protections for the independent contractor and company or client ⇗ Is a 1099 a contractor? 1099 Contractor 50/50 split Same $96,000 1099 gets $48,000 You get $48,000$19,0 (% for expenses) = $28,800 But, your expenses will not go up much, renting her/him space will be the same, so post $28,800 you may only have 10% in expenses

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

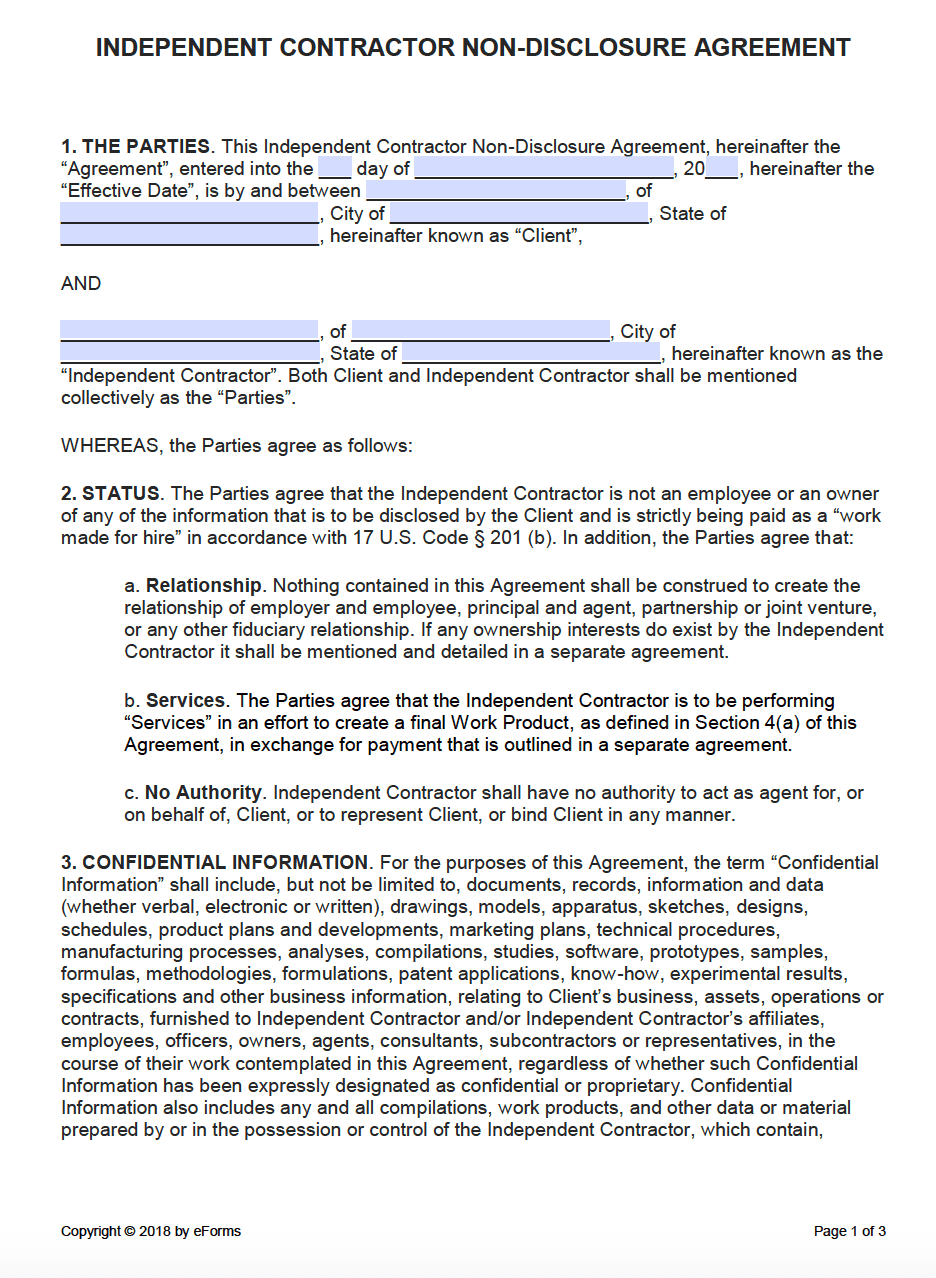

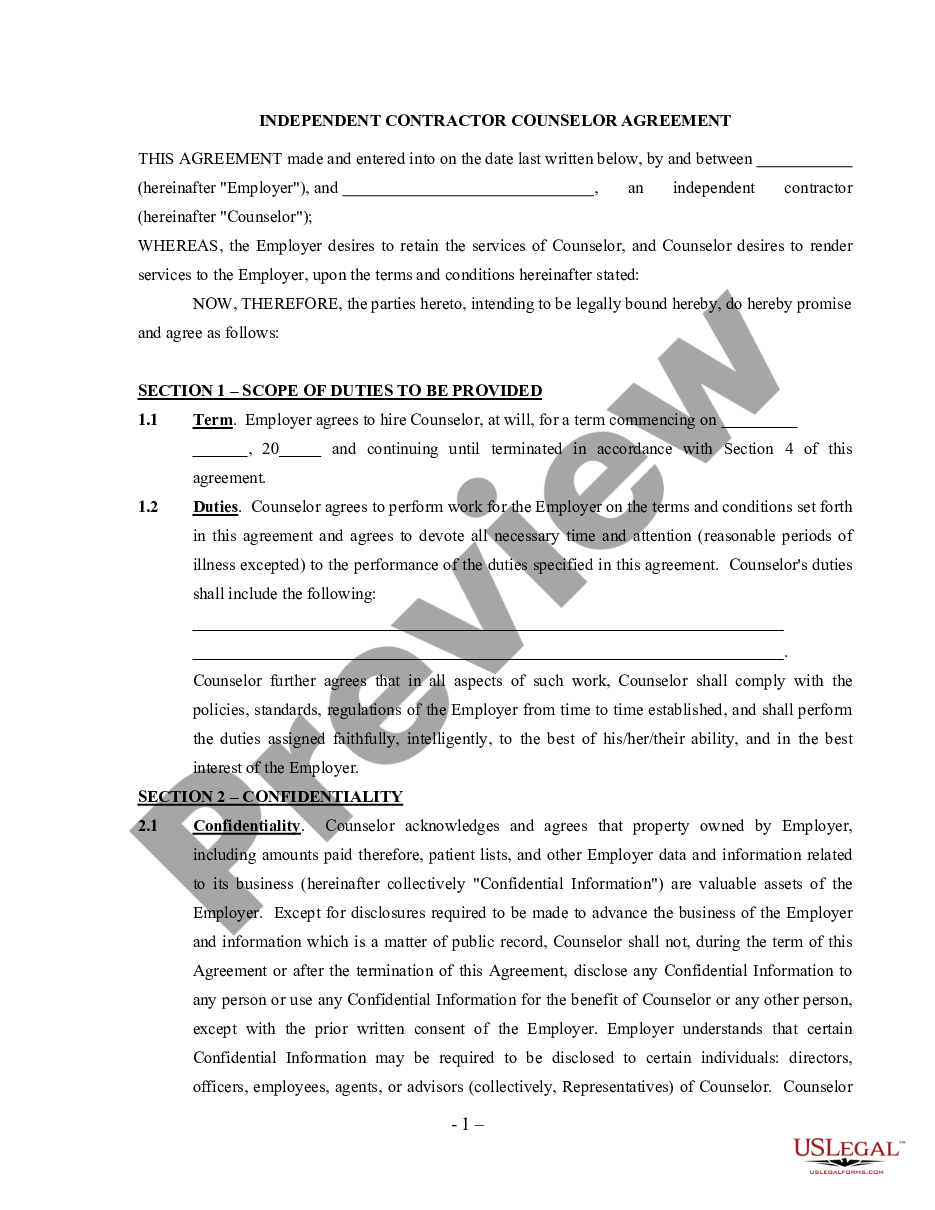

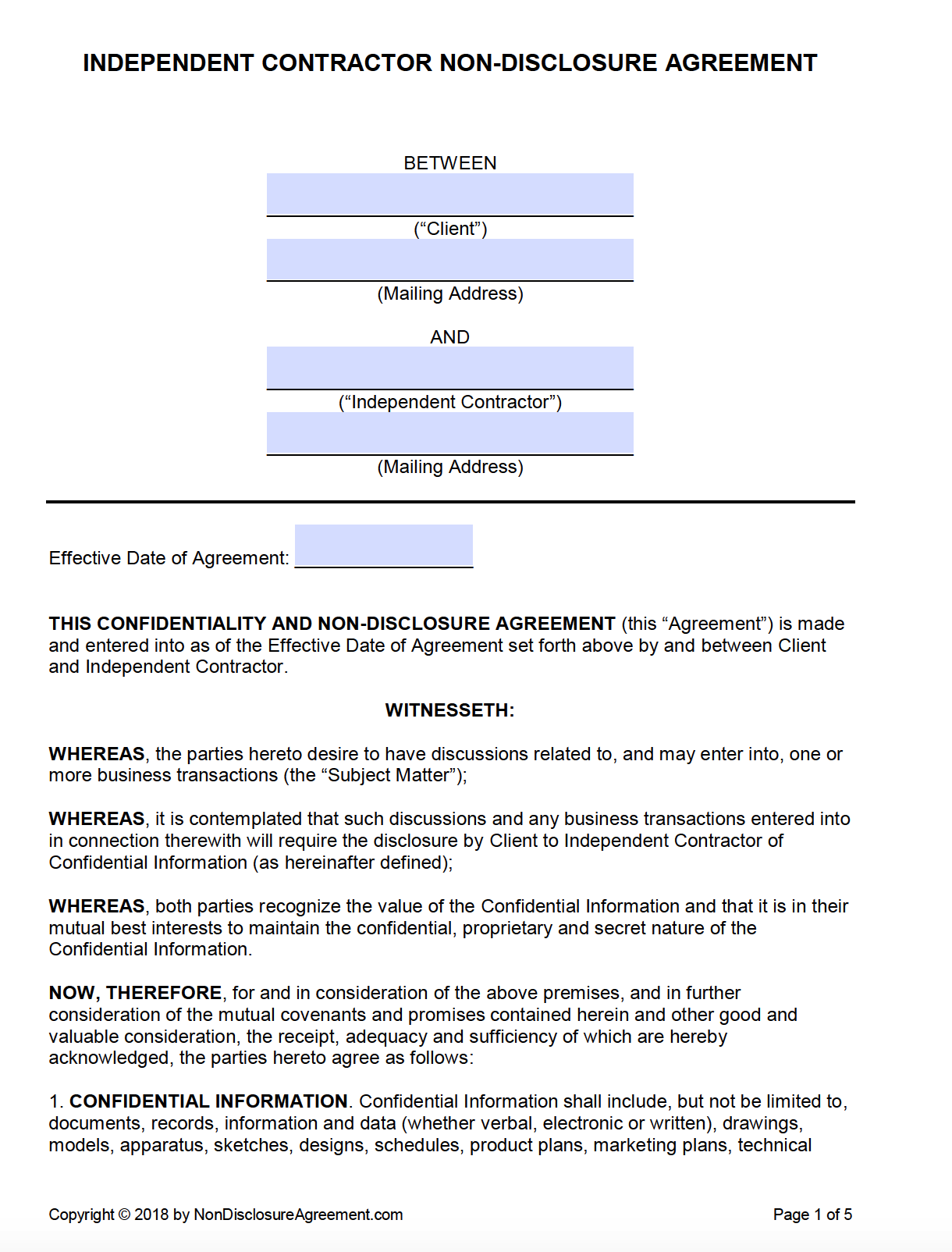

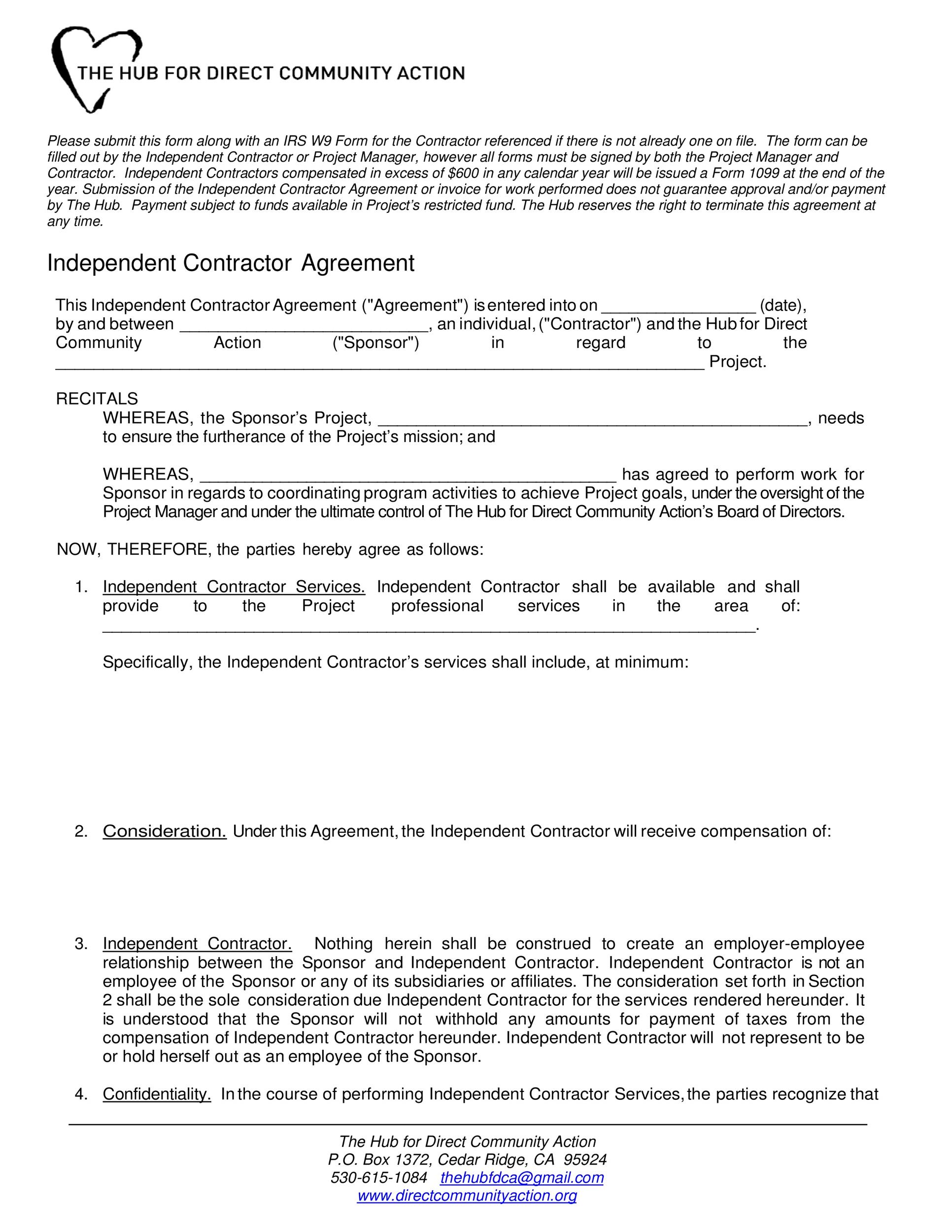

A contractor confidentiality agreement also known as a nondisclosure agreement is a legally binding written agreement between the client and the one who renders service to the client contractor Independent Contractor Confidentiality Contract Template NonDisclosure Agreement NDA 225What is the purpose of an independent contractor agreement?Sample 1 Independent Contractor Indemnification It is understood and agreed, and it is the intention of the parties hereto, that during the Term, Brill shall be an independent contractor, and not the employee, agent, joint venturer or partner of the Company for any purpose whatsoever Nothing contained in this Agreement shall be construed to

Independent Contractor Agreement

3

Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade_____, the undersigned Independent Contractor ("CONTRACTOR") A DUTIES OF THE INDEPENDENT CONTRACTOR 1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;Independent Contractor Status The parties acknowledge that Contractor is and shall at all times be an independent contractor and not an employee of the Companies The parties agree a The Companies shall have no right to direct the manner in which Contractor performs the Services;

8 Independent Contract Templates Free Word Pdf Google Docs Apple Pages Format Download Free Premium Templates

How To Write An Independent Contractor Agreement Mbo Partners

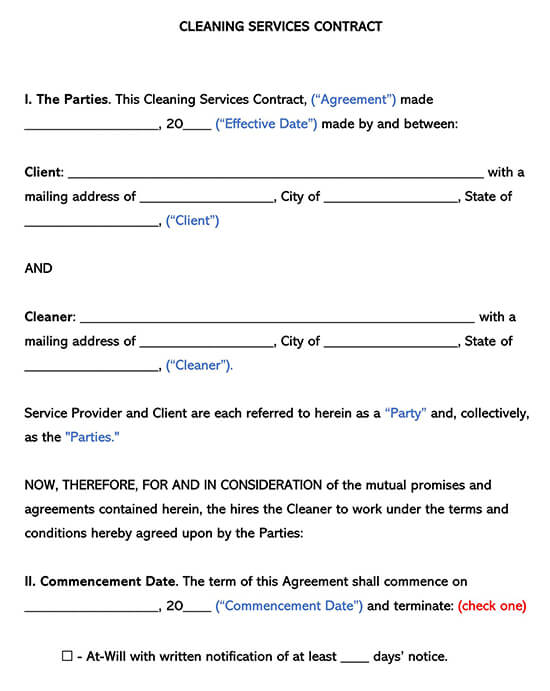

Independent Contractors The gig economy continues to spread across industries, increasing the use of independent contractors for temporary assignments and as part of organizationalAn independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for paymentThe client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injured during the3 Company desires to utilize the education, training and/or work experience of Contractor as an independent contractor in Company's counseling business;

Self Employment Contract Sample Employment Ihtf

Free Independent Contractor Agreement Pdf Word

Download Nursing Agreement SelfEmployed Independent Contractor right from the US Legal Forms site It gives you a wide variety of professionally drafted and lawyerapproved documents and samples For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscriptionThe Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 ServicesIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, Agreement Independent Contractor agrees that customers of the Company shall include, but are not limited to the following

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

1099 Form Independent Contractor Agreement

4 Contractor affirms that Contractor is not subject to any agreement or covenant not to compete which would prohibit or limit Contractor from fulfilling this Agreement;Independent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf of You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Template Contract The Legal Paige

Any customer as a house account, without the Representative's agreement 6 Independent Contractor It is understood that the Representative is an independent contractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood thatAn independent contractor agreement is a contract between a client that pays a 1099 contractor for their services An independent contractor is not an employee Therefore, the client is not responsible for tax withholdings or health benefits In most cases, an independent contractor is paid on a perjob or percentage (%) basis, not by the hourProvided however, the Services must be provided at the

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

What Is A 1099 Contractor With Pictures

Independent contractor shall be responsible for providing all tools and materials required for performance of the tasks agreed to independent contractor is responsible for payment of all federal, state and local income taxes dated _____ _____ contracting party by an authorized officer _____ independent contractor agreement for independentFulton Avenue HealthCare 72 Fulton Avenue, Suite 300 Hempstead, NY Phone Nurse Practitioner Independent Contractor AgreementINDEPENDENT CONTRACTOR AGREEMENT NoticesAll notices hereunder shall be in writing and shall be sent by registered mail or certified mail, return receipt requested, postage prepaid and with receipt acknowledged, or by hand (to an officer if the party to be served is a corporation), or by facsimile or by email, all charges prepaid, at the respective addresses set forth below

2

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

As well as your own health benefits, medical expenses, life insurance, and retirement fundINDEPENDENT CONTRACTOR AGREEMENT THIS INDEPENDENT CONTRACTOR AGREEMENT (the It is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federal, state, and local income tax laws To the extent either Party is required by law to demonstrate compliance with any Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Most selfemployed individuals will need to pay selfemployment tax (comprised of social security and Medicare taxes) if their

Melody Veitch Melodyveitch Profile Pinterest

Independent Contractor Agreement Template Free Pdf Sample Formswift

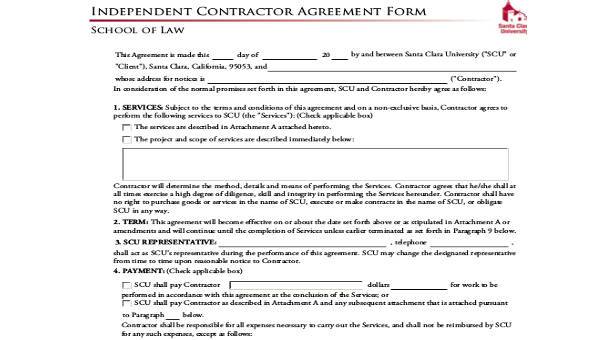

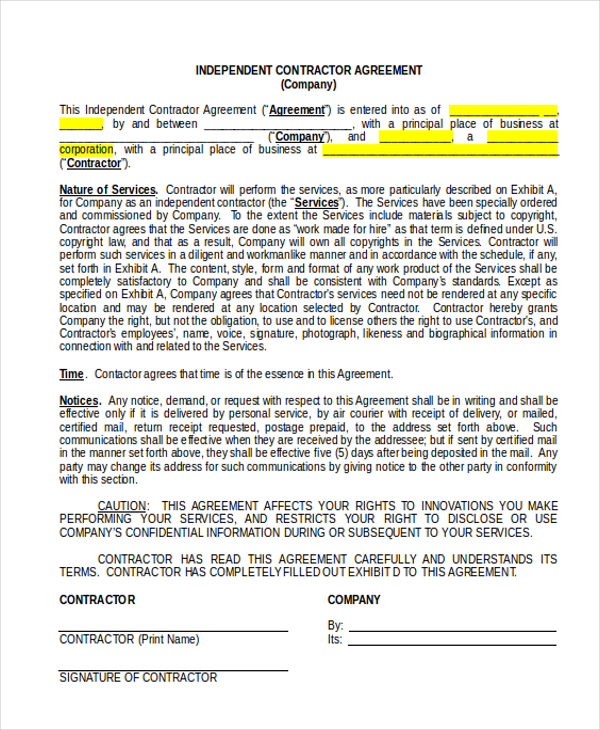

The contract signed between a contractor and their client is known as an Independent Contractor Agreement This legal document is designed to outline the core elements of the transaction between the hiring client and the contractor An Independent Contractor Agreement can also be known as a Freelance Contract Consulting AgreementAnd (c) the Services andAGREEMENT for independent contracting services made between and GAEL CASNER D/B/A COLLEGE FIND COLLEGE FIND is THE CONTRACTING PARTY and (XX) is the INDEPENDENT CONTRACTOR 1 Engagement of Services College Find hereby engages as an independent contractor to provide office and research assistance on an as needed basis 2

:max_bytes(150000):strip_icc()/contracting-papers-92244195-576860795f9b58346a0384c7.jpg)

Hiring And Paying An Independent Contractor

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Independent contractor/Consultant If the services/work will be free from – 12 or more of the employer controls illustrated in the characteristics, the individual may be engaged as a contractor/consultant and paid according to the requirements that follow for engagingIndependent Contractor Agreement Note This document does not reflect or constitute legal advice This is a sample made available by the Organizations and Transactions Clinic at Stanford Law School on the basis set out at nonprofitdocumentslawstanfordedu Your use of this document does not create an attorneyclient1099 Contractors and Freelancers The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment tax Selfemployment taxes total roughly 153%, which includes Medicare and Social Security taxes Your income tax bracket determines how much you should save for income tax

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Home Decorating Style 21 for 1099 Independent Contractor Agreement Sample, you can see 1099 Independent Contractor Agreement Sample and more pictures for Home Interior Designing 21 at Resume Example IdeasIf you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in a year You must send all completed 1099 forms to the IRS before January 31 of the following yearThat in performing under the Agreement;

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Free Sample Independent Contractor Agreement Form Master Of Template Document

The independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without aExhibit 102 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT ("Agreement") is made and entered into as of , by and between ProDex, Inc (the "Company"), with its principal place of business located at 2361 McGaw Ave, Irvine, California , and Mark Murphy ("Independent Contractor"), an individual with his principal_____, the undersigned Independent Contractor ("CONTRACTOR") A DUTIES OF THE INDEPENDENT CONTRACTOR 1 Definition CONTRACTOR is responsible for your own taxes through a 1099 tax form at the end of every filing year;

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contract Template Contractors

The Principal and Independent Contractor hereby agree that during the term of this Agreement and any extensions hereof, this agreement and the employment of the Independent Contractor may be terminated and the Independent Contractor's compensation shall be measured to the date of such termination (i) at will by either party with 90 (ninety

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

1099 Form Independent Contractor Agreement

1099 Form Independent Contractor Free

Free Independent Contractor Agreement Templates Word Pdf

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Counselor Agreement Self Employed Independent Contractor Mental Health Therapist Contract Agreement Us Legal Forms

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Independent Contractor Agreement Download Pdf Word Agreements Org

50 Free Independent Contractor Agreement Forms Templates

Sample Independent Sales Rep Agreement New York Medcepts

Independent Contractor Contract Template The Contract Shop

50 Free Independent Contractor Agreement Forms Templates

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Exh10 1 Htm

Free Independent Contractor Agreement Free To Print Save Download

Freelance Contract Create A Freelance Contract Form Legaltemplates

1

34 Printable Sample Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement Example

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Truck Driver Independent Contractor Agreement New Truck Driver Contract Agreement Template 21 Awesome Trucking Pany Models Form Ideas

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement Template Download Printable Pdf Templateroller

50 Free Independent Contractor Agreement Forms Templates

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

2

Free Independent Contractor Agreement Templates Word Pdf

Free Independent Contractor Agreement Templates Word Pdf

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Sample Independent Contractor Non Compete Agreement Word Pdf

Free Independent Contractor Agreement Template What To Avoid

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Texas Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Create An Independent Contractor Agreement Download Print Pdf Word

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template Download Wise

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Texas Fill Online Printable Fillable Blank Pdffiller

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free Independent Contractor Agreement Templates Word Pdf

1099 Form Independent Contractor Agreement

50 Free Independent Contractor Agreement Forms Templates

1

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Free Independent Contractor Agreement Template What To Avoid

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

Free Independent Contractor Agreement Templates By State With Guide

Independent Contractor Agreement Template Contract The Legal Paige

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

50 Free Independent Contractor Agreement Forms Templates

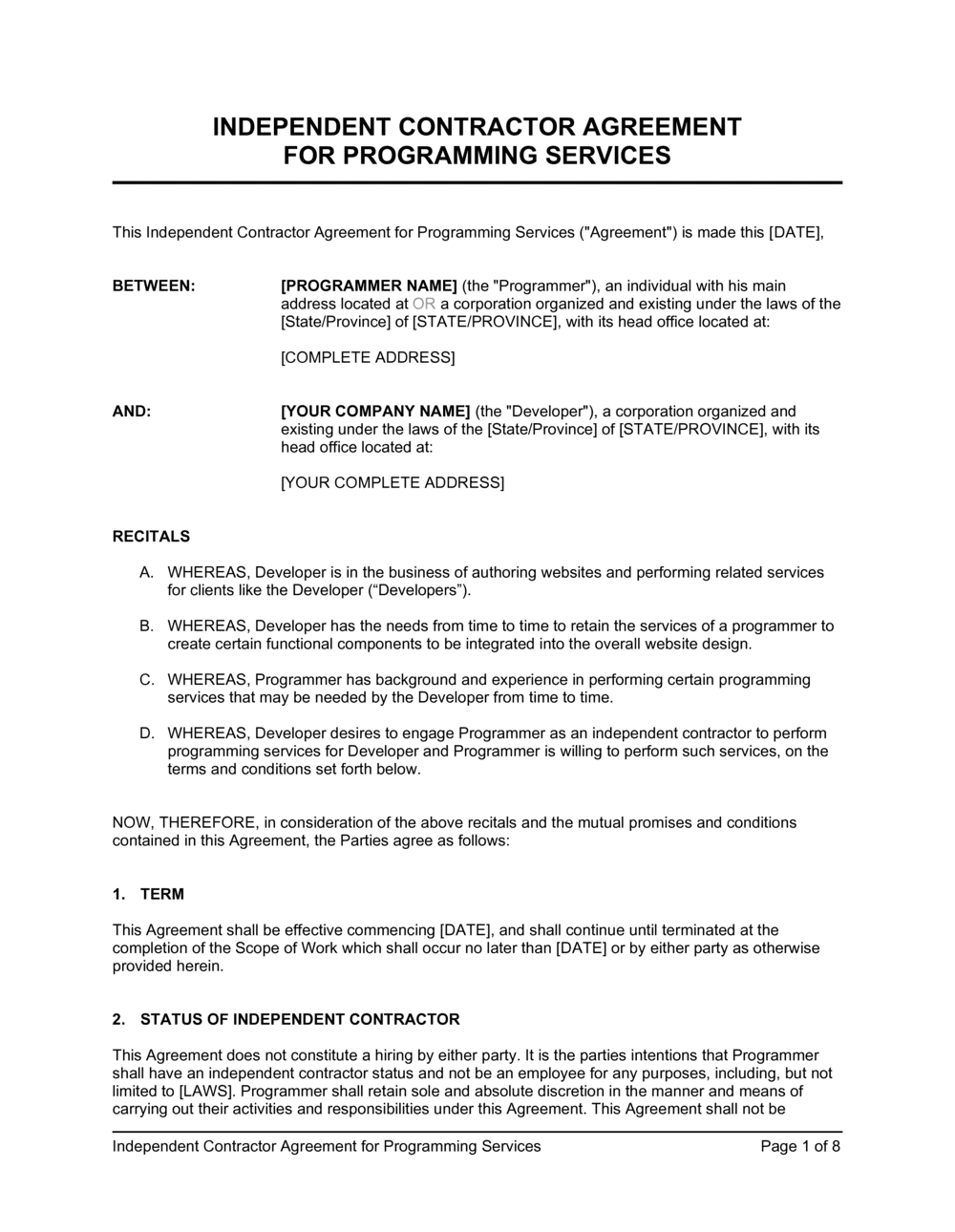

Independent Contractor Agreement For Programming Services Template By Business In A Box

1099 Form Independent Contractor Free

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement In Word And Pdf Formats

Sample Employment Verification Letter For Independent Contractor Download Printable Pdf Templateroller

Free Subcontractor Agreement Free To Print Save Download

Agreement Form Template Fill Out And Sign Printable Pdf Template Signnow

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

2

3

Independent Contractor Agreement In Word And Pdf Formats

Contractors Contract Template Fill Online Printable Fillable Blank Pdffiller

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free Illinois Independent Contractor Agreement Pdf Word

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Sample Independent Contractor Agreement Template Free Download Speedy Template

Independent Contractor Agreement Not Your Father S Lawyer

0 件のコメント:

コメントを投稿